CA RRF-1 2005-2026 free printable template

Fill out, sign, and share forms from a single PDF platform

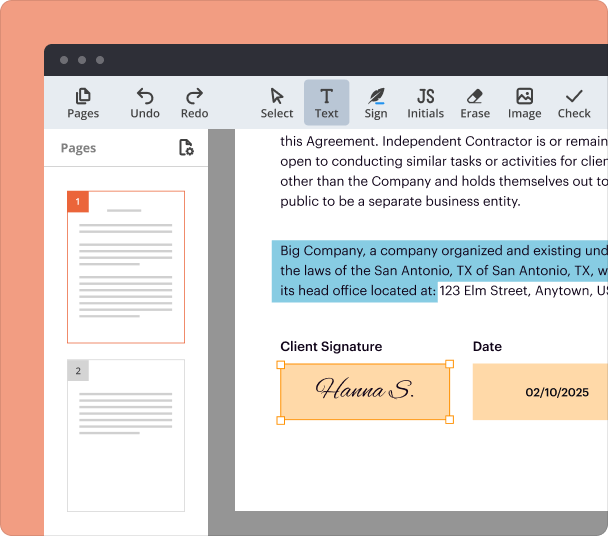

Edit and sign in one place

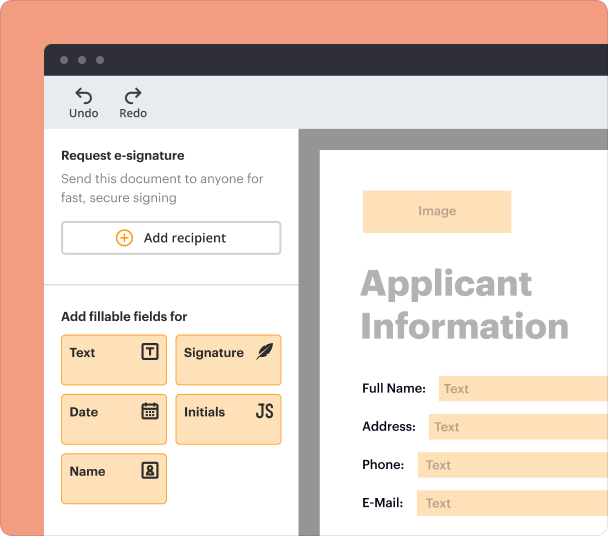

Create professional forms

Simplify data collection

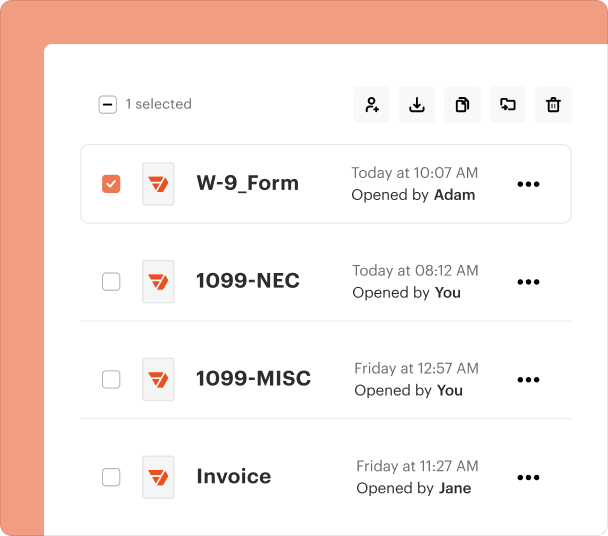

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

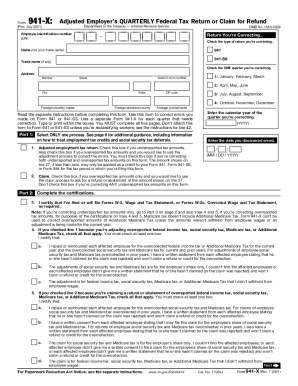

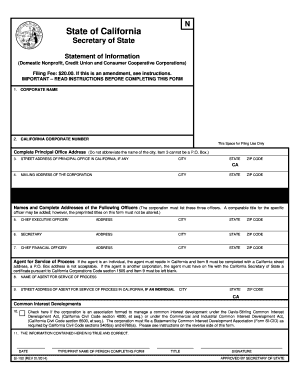

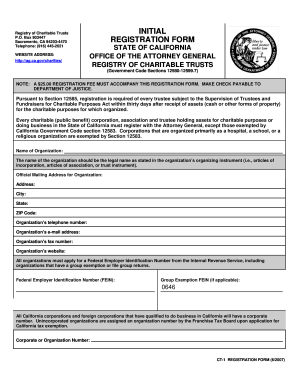

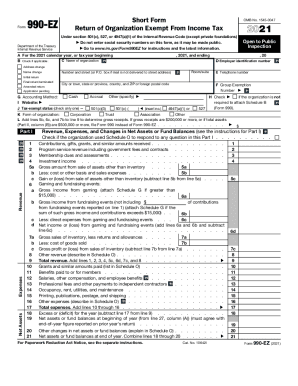

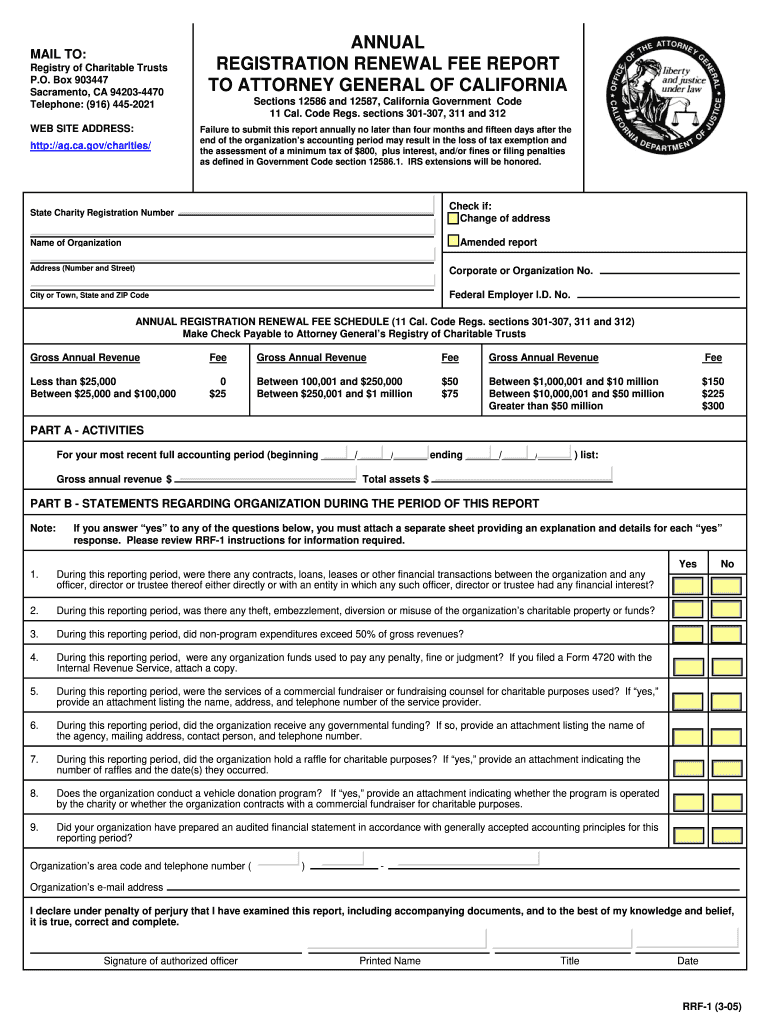

Understanding the CA RRF-1 2 Printable Form

What is the CA RRF-1 2 Printable Form?

The CA RRF-1, or the Annual Registration Renewal Fee Report, is a document required by the California Attorney General's Registry of Charitable Trusts. This form is essential for nonprofits operating in California to report their financial activities and comply with state laws. It ensures transparency and accountability in the nonprofit sector.

Who Needs the CA RRF-1 2 Printable Form?

Any charitable organization registered in California must submit the CA RRF-1 form annually. This includes organizations operating solely for charitable purposes, as well as those that engage in activities that generate revenue. Each entity must fill out this form regardless of their income level to maintain their registered status.

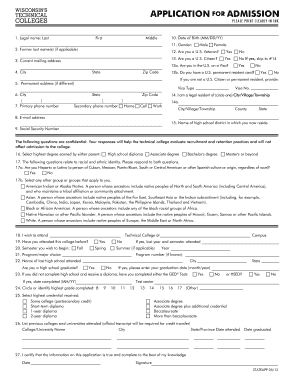

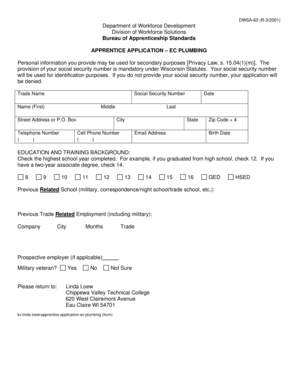

Required Documents and Information

To successfully complete the CA RRF-1, organizations need to gather several key pieces of information. This includes their federal Employer Identification Number, a summary of gross income and expenses, and details of their activities. Accurate financial records are crucial for filling out the form effectively.

How to Fill the CA RRF-1 2 Printable Form

Filling out the CA RRF-1 form should be done with care. Begin by reviewing the instructions provided with the form. Ensure all financial data is current and reflects the organization’s accounting period. Pay special attention to the sections regarding financial activities and governance, as accurate reporting is critical for compliance.

Common Errors and Troubleshooting

Common pitfalls when completing the CA RRF-1 include incorrect financial calculations and missing information. Organizations should double-check that all relevant data is entered correctly and that all required attachments are included. When in doubt, consulting previous submissions or seeking professional advice can help ensure accuracy.

Submission Methods and Delivery

Once the CA RRF-1 form is completed, organizations must send it to the California Attorney General's Registry of Charitable Trusts. This can often be done through mail, so it is advisable to keep a copy of the form and any accompanying documents for your records. Timely submission is crucial to avoid late fees and penalties.

Frequently Asked Questions about rrf 1 form

What happens if the CA RRF-1 is not submitted on time?

Failing to submit the CA RRF-1 on time can result in penalties, including the potential loss of tax-exempt status and fines imposed by the California Attorney General's office.

Can the CA RRF-1 form be filed electronically?

Currently, the CA RRF-1 form must be printed and submitted via mail. Ensure to check with the California Attorney General's office for any updates regarding electronic filing.

pdfFiller scores top ratings on review platforms